Note: Report all of your income to avoid overpayment, penalties, and a false statement disqualification.

Maximum benefits paid edd full#

So you would be eligible for the full WBA of $600. This does not exceed the regular wages of $1,000 per week. Full WBAĬalculation: $300 part-time wages + $600 WBA = $900. So you would be eligible for a partial WBA of $500 ($600 WBA - $100 over your regular wage). This amount exceeds the regular wages of $1,000 per week by $100. Reduced WBAĬalculation: $500 part-time wages + $600 WBA = $1,100.

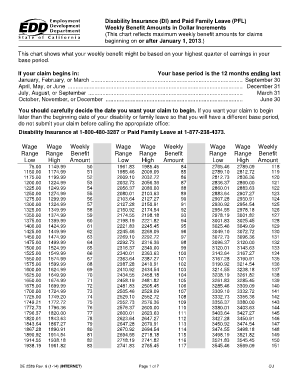

In both examples, we use regular weekly wages of $1,000 and an estimated WBA of $600. Here are examples to help you determine if you qualify for a reduced (partial) or full WBA. If your part-time wages and benefits combined exceed your regular weekly wages, your weekly benefit amount (WBA) may be reduced. You may still be eligible for benefits if you’re working part time during your disablity period. Are working part time, intermittently, or reduced hours.Have late court-ordered child or spousal support payments due.Have a benefit overpayment for a previous Unemployment Insurance, Paid Family Leave, or DI claim.More than $6,803.34, your WBA is approximately 60 percent of your earnings.Between $929 and $6,803.34, your WBA is approximately 70 percent of your earnings.How Your Weekly Benefit Amount is Calculated Your actual WBA will be confirmed once your claim has been approved. Note: The calculator is intended to provide an estimate only. You can get a general estimate by using our online calculator. The base period is the 12 months ending last June 30.Įxample: A claim beginning November 2, 2022, uses a base period of July 1, 2021, through June 30, 2022. The base period is the 12 months ending last March 31.Įxample: A claim beginning September 27, 2022, uses a base period of April 1, 2021, through March 31, 2022. The base period is the 12 months ending last December 31.Įxample: A claim beginning June 20, 2022, uses a base period of January 1, 2021, through December 31, 2021. The base period is the 12 months ending last September 30.Įxample: A claim beginning February 14, 2022, uses a base period of October 1, 2020, through September 30, 2021. If a claim begins on or after January 1, 2022:

The following information may be used to determine the base period for your claim. For a DI claim to be valid, you must have at least $300 in wages in the base period. The base period does not include wages paid at the time your disability begins. The base period includes wages subject to SDI tax that were paid about 5 to 18 months before your disability claim began.

Your benefit amount is based on the quarter with your highest wages earned within the base period.Ī base period covers 12 months and is divided into four consecutive quarters.

0 kommentar(er)

0 kommentar(er)